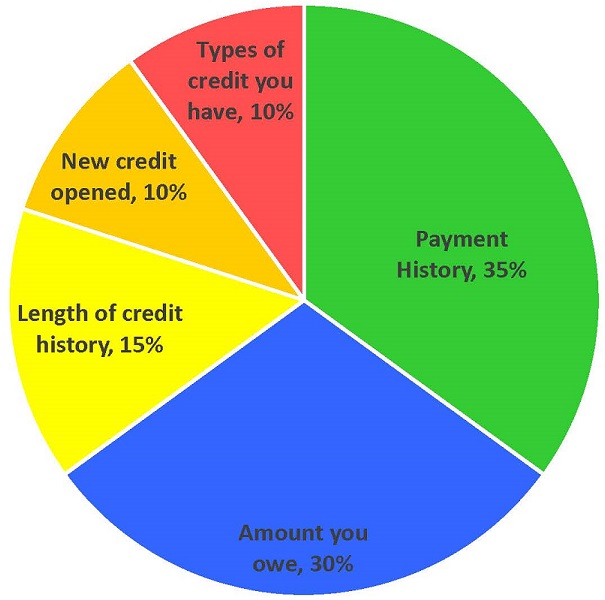

Amount you Owe - 30%

Just because you have it, doesn't mean you should use it. Most credit correction companies will tell you not to use more than 35% of your available credit. That's right, 35%! For example, if you have a credit limit of $1,000 - you shouldn't carry a balance of more than $350 per month. Length of Credit History - 15% When you're cleaning up your credit act, don't close your oldest credit cards. Even if they have a lower credit limit than others, you should still keep them open to maintain that credit history. New Credit Opened - 10% Too many new accounts can negatively impact your score. Not only too many new accounts, but also too many inquiries. NOTE: When purchasing a house and picking a lender, you have a 30 day shopping window to pull your credit several times to do your due diligence and find the best rates and lowest fees. As long as you keep the inquiries all within a 30 day period and you're pulling your credit for the same purpose of getting a mortgage, your credit won't be negatively impacted. Take advantage of this! Types of Credit you Have - 10% You get a bonus for having various types of credit - but don't go overboard. Everything in moderation. If you're a suburbanite with a good job, you likely have/had a car payment, cell phone, a credit card or two and possibly a student loan - that should cover your bases.

0 Comments

Leave a Reply. |

AuthorKelly Martinez, Archives

April 2024

|